PEEKABOO SRL

🇷🇴

General information about business

-

Registration date12 Aprilie 2005

-

Web page

-

Tax number (CIF/CUI)1004606005848

-

Check on date.gov.md

-

Social media

Key information

Degree of risk and interest

Loans

Other credit details

Other details

The purpose and objectives of the project

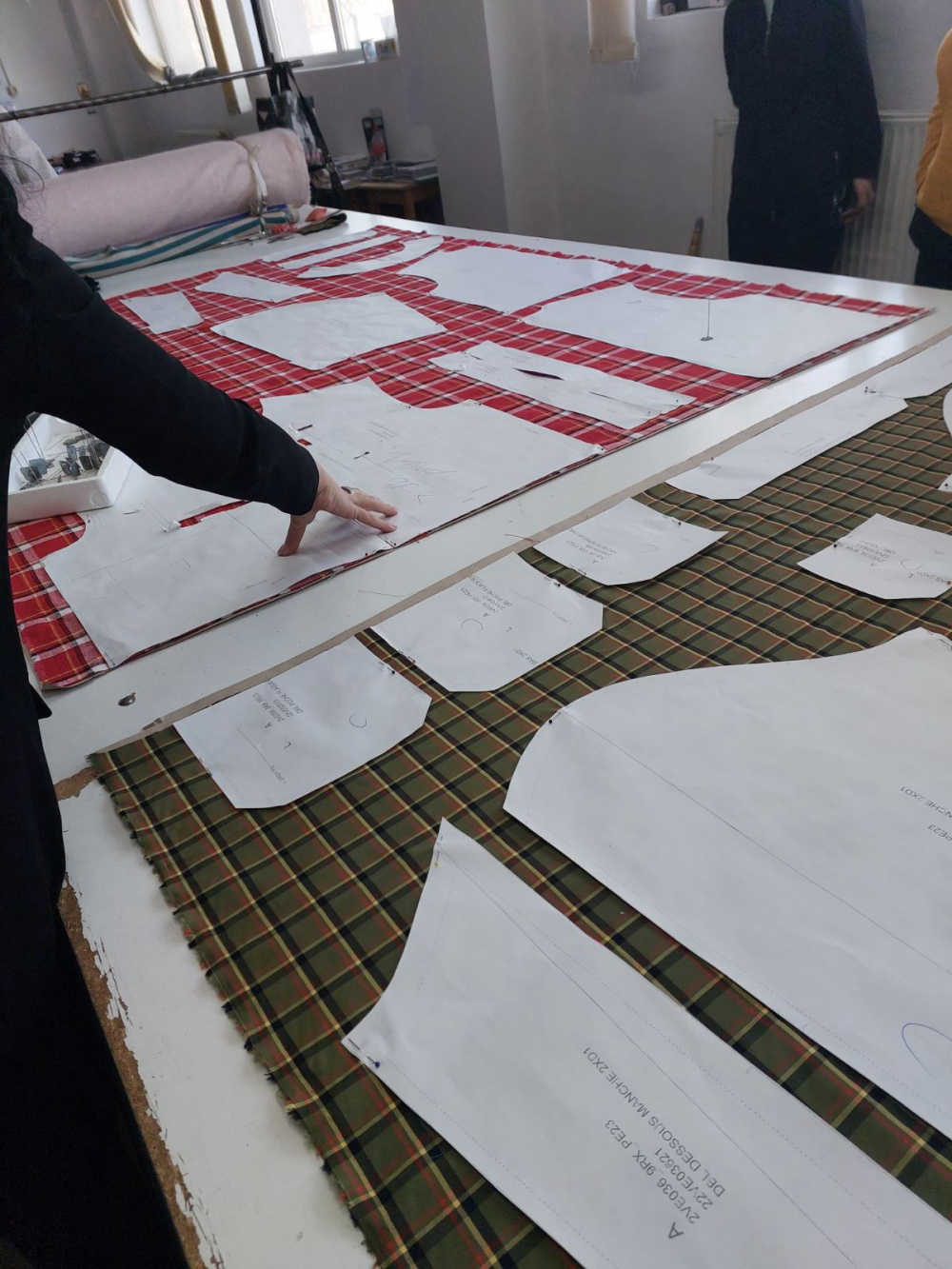

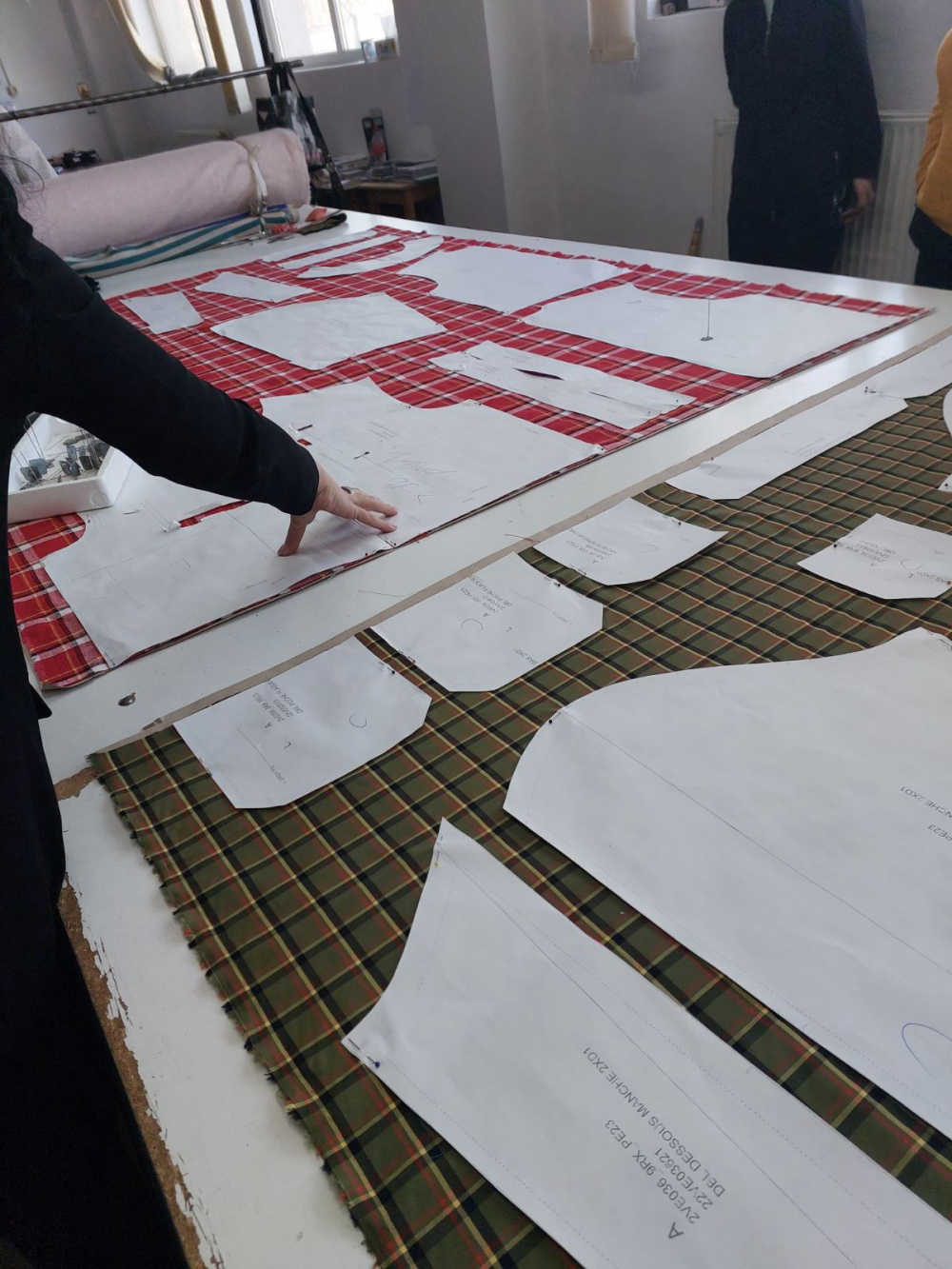

Main activities and products / services offered

Notable achievements

Project team and relevant experience

McFly. That's right, he's gonna be mayor. C'mon man, let's do something that really cooks. yes, Joey just loves being in his playpen. he cries whenever we take him out so we just leave him in there all the time. Well Marty, I hope you like meatloaf. Marty, that's completely out of the question, you must not leave this house. you must not see.

Biff. That's a great idea. I'd love to park. Does your mom know about tomorrow night? Marty you gotta come back with me. Well, she's not doing a very good job.

Uh, coast guard. Quiet, quiet. I'm gonna read your thoughts. Let's see now, you've come from a great distance? I'll call you tonight. Chuck, Chuck, its' your cousin. Your cousin Marvin Berry, you know that new sound you're lookin for, well listen to this.

Documents

Important note: Financial statements are extracted from tax authorities. And the information in the documents provided by the contractor has not been reviewed or approved by Fagura

McFly. That's right, he's gonna be mayor. C'mon man, let's do something that really cooks. yes, Joey just loves being in his playpen. he cries whenever we take him out so we just leave him in there all the time. Well Marty, I hope you like meatloaf. Marty, that's completely out of the question, you must not leave this house. you must not see.

Biff. That's a great idea. I'd love to park. Does your mom know about tomorrow night? Marty you gotta come back with me. Well, she's not doing a very good job.

Uh, coast guard. Quiet, quiet. I'm gonna read your thoughts. Let's see now, you've come from a great distance? I'll call you tonight. Chuck, Chuck, its' your cousin. Your cousin Marvin Berry, you know that new sound you're lookin for, well listen to this.

Informații financiare

Risks

Fagura scoring assesses a company's risk by assigning a score between 0 and 100 based on public data from credit bureaus and tax authorities. The profile of the founders and the company's financial history are analyzed to generate this score. A higher score indicates a less risky investment, while a score close to zero signals a major risk. All these details are available in the key information sheet (SME Pitch). Please note, this information does not constitute investment advice and the final decision rests solely with the investor, who should personally review the data.

Risks and risk management strategies

The risk that a project or the project developer will be subject to bankruptcy or other insolvency proceedings, as well as other events related to the project or the project holder that may result in investors losing their investment.

In the "Pitch" section, risks and risk management strategies were exposed. It is important that investors are aware that there may be other risks, but not limited to to:

In the "Pitch" section, risks and risk management strategies were exposed. It is important that investors are aware that there may be other risks, but not limited to to:

1. Risks related to the project

Risks that are inherent in the project and that may cause it to fail. Risks respectively may include, but are not limited to:

(i) the aspects on which the project depends, such as financing, legal aspects, grantinglicenses and authorizations, copyright;

(ii) the materialization of unfavorable scenarios with a negative impact;

(iii) the technological development of competitors or the appearance of competitive products;

(iv) risks related to the project developer.

2. Sectoral risks

Risks inherent in a certain sector. Such risks can be caused, for example, by o change in macroeconomic circumstances, by a decrease in demand in the sector the crowdfunding project is OPERATING and dependence on other sectors.

The project sector is described using the nomenclature mentioned in Article 2 Article (1) letter (a) of Regulation (EC) no. 1893/2006 of the European Parliament and of the Council(5).

3. Risks of default

The risk that a project or the project developer will be subject to a proceeding of bankruptcy or other insolvency proceedings, as well as other events related to the project or to the project owner that may lead to investors losing their investment.

Such risks can be caused by a number of factors, including:

(a) a (significant) change in the macroeconomic situation;(b) mismanagement;

(c) lack of experience;

(d) fraud;

(e) a financing that does not correspond to the commercial purpose;

(f) failure to launch a product;

(g) insufficient liquidity flows.

4. The risk of a lower return on investment, a late return or a zero yield

The risk that the return on the investment will be lower than expected, occur late or to capital or interest payments related to the project cannot be honored.

5. Risk of platform malfunction

The risk that the crowdfunding platform will not be able to deliver the services, either temporarily or permanently.

6. The risk of illiquidity of the investment

The risk that investors will not be able to sell their investment.

7. Other risks

Risks that are, among other things, beyond the control of the project developer, such as it would be political and regulatory risks.

Investors

McFly. That's right, he's gonna be mayor. C'mon man, let's do something that really cooks. yes, Joey just loves being in his playpen. he cries whenever we take him out so we just leave him in there all the time. Well Marty, I hope you like meatloaf. Marty, that's completely out of the question, you must not leave this house. you must not see.

Biff. That's a great idea. I'd love to park. Does your mom know about tomorrow night? Marty you gotta come back with me. Well, she's not doing a very good job.

Uh, coast guard. Quiet, quiet. I'm gonna read your thoughts. Let's see now, you've come from a great distance? I'll call you tonight. Chuck, Chuck, its' your cousin. Your cousin Marvin Berry, you know that new sound you're lookin for, well listen to this.